Long Term B-Wave Top Has Finally Arrived

As regular readers of the BullBear Market Report know, I have been expecting to see a B-wave high in a largely sideways long term formation. It seems to me that chances are fairly high that we have seen the top of the B-wave rally off the September 2022 low. The next move is then a C-wave decline, the third movement in the pattern that started with the top made in December 2021.

This rally has dragged on a bit higher and longer than expected and has lingered for some time above the 2021 high, but technical signs are strong that with today’s news of hot inflation, we have seen the top. The rally has been largely based on the notion that the Fed would be able to cut interest rates and resume its easy money policies, but that seems to have been called into question, with projections for rate cuts dropping sharply in short order.

It’s very likely that the algorithmic machines of the large players can read the same tea leaves, and with public enthusiasm for “the market” running hotter than Fed rate cut expectations, it’s probably time for a trading washout that will set up the next trading buy.

Chances are very high that we have recently seen the first minor degree a-wave decline from the top and that now we will see a minor degree b-wave rally that will recover much of the recent losses. From there, the main movement of the first intermediate term decline will begin. So active traders should be looking for an opportunity to lighten up positions in the coming weeks.

In strategic terms, this is a call for a trading high, so if you have been long from lower levels, this is the time to take profits on the trade and get ready to buy again when this decline completes later in the year. Long term investment capital in Big Tech and the major capitalization stocks is safe, but one could place a hedge here to protect profits. As I have been saying for quite some time, it is time to exit small cap stocks, since the major economic disruptions that will reconfigure all of economics is going to hit that sector hard, with entire swaths of smaller and mid cap issues seeing their fundamental business models eradicated.

Aggressive traders could attempt a short play here, but it’s definitely not a “bet the farm” scenario. A better approach is to lighten up or hedge longs and prepare to buy the C-wave dip.

Let’s have a look at the charts, with a focus on the long term Monthly view.

SPY monthly:

We have the 2021 high as the end of a long term bull move from the 2011 bear market termination point. The top came with an exhaustion move above the upper rail of the green long term trend channel. The A-wave low came with a touch of the blue 50 month EMA. The current high is showing a large bear RSI divergence, which is very common at such highs. You can look back at the 2018 and 2019 highs and see a similar bear pattern leading into the 2020 crash. Historically, large bear RSI divergences like this have been strong predictors of a significant top. During the last major period of consumer price inflation, in the 70’s and 80’s, there was a similar long term sideways pattern with the tops marked by bear RSI divergences.

It is also significant that price is now contacting the upper rail of the long term green channel, marking a point of technical resistance.

I would not expect a lower low in SPY, but rather a higher low with a retest of the blue 50 month EMA, which has been key support since 2011.

QQQ monthly:

Confirms the analysis of the SPY chart.

DIA monthly:

Basically the same scenario playing out.

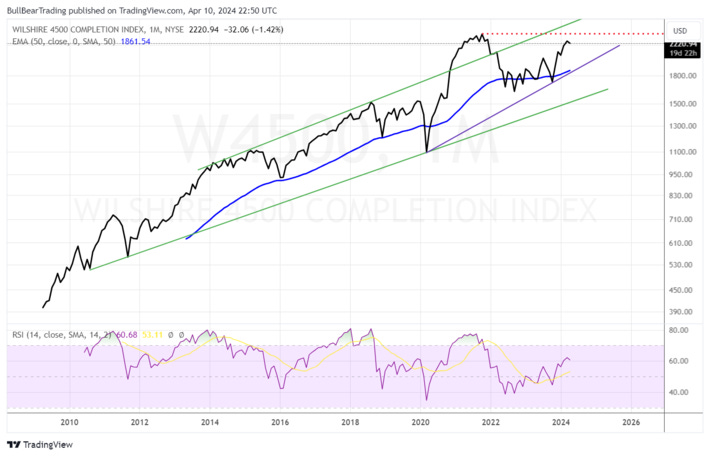

Wilshire 4500 (total market excluding SPX 500) shows a large non-confirmation of the new high, which when combined with the bear RSI divergences, contributes to a bearish setup.

Small cap stocks are not only not confirming, but are set up to break lower on a long term basis.

It would only take about a -10% drop (not a lot for the small cap sector) to take out the 50 month EMA and then the green long term channel. The pattern is one of the clearest A-B bear sequences you are likely to see. If all charts looked like this I would be very bearish on the long term.

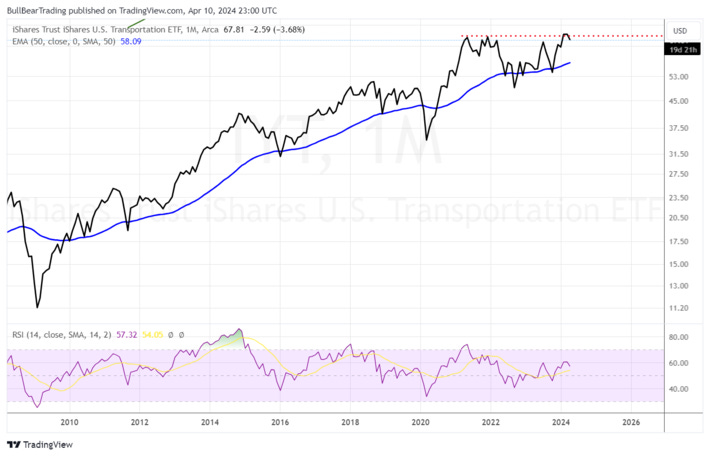

Transports barely managed to make a new high, bit are now back below the 2021/2022 high marks.

Let’s have a look at the weekly charts.

SPY weekly confirms the look of the monthly chart with a poke above the upper green resistance rail just as RSI has reached long term upside extended technical condition.

A retreat of about 20% would reset RSI back to its support zone and retest the October 2023 low and probably the red 200 week EMA as well. Both traders and investors would want to buy that.

QQQ weekly:

Same picture, but with the added feature of a long series of weekly RSI divergences going back to February.

Now let’s look at some daily charts, which show that we have probably seen a short term low and will now see a rally.

SPY daily:

Daily RSI reached its downside extended support. The 20 day and 50 day EMAs are close to a bearish cross. Generally this is a setup for a reaction rally. Active traders would want to sell into that.

QQQ daily:

Reached lower support on RSI as the main green trendline and the red 200 day EMA were approached. Look for a rally back to the 50 day EMA in blue, and sell into it if you are an active trader.

IWM daily:

RSI reached support as the red 200 day EMA was contacted. This is going to be the last best chance to get the hell out of small cap stocks before this sector goes into a serious decline.

There are quite a few bearish setups on the technical charts that confirm the long and intermediate term analysis.

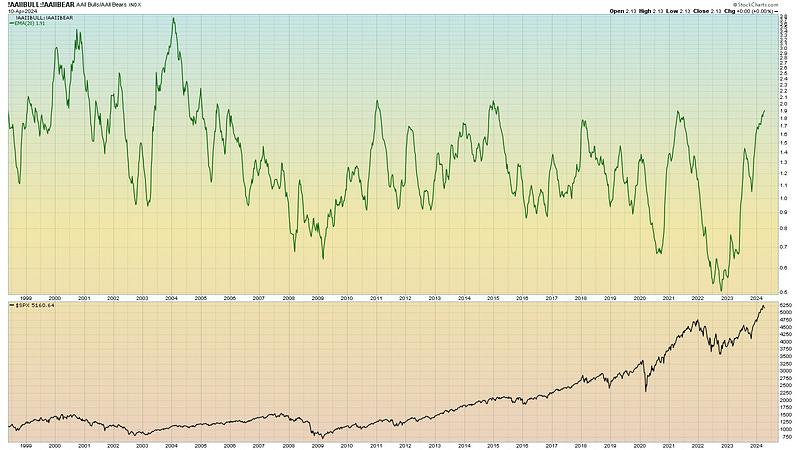

The Bull/Bear sentiment ratio reached the same level that it did before the 2020 top, so all are on board and committed.

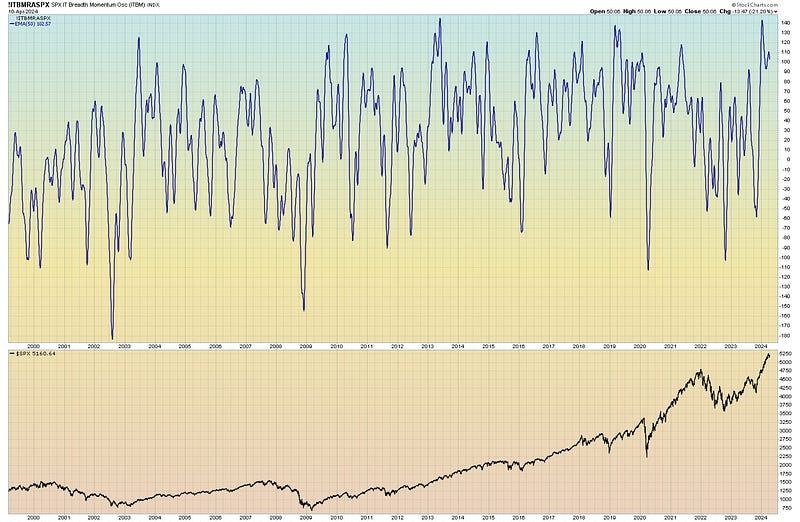

50 week Breadth Momentum Oscillator got very upside extended and then put in a large bear divergence.

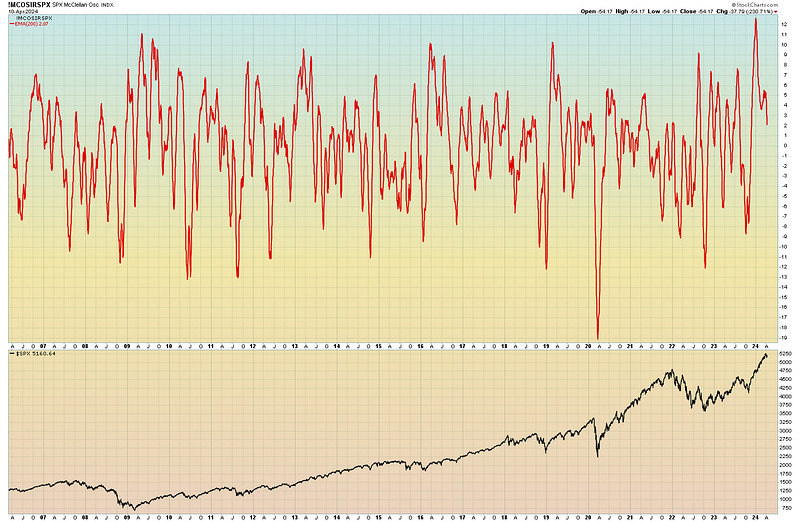

Same for 200 Day SPX McLellan Oscillator. Got more upside extended than ever and then put in a large bear divergence and is falling hard.

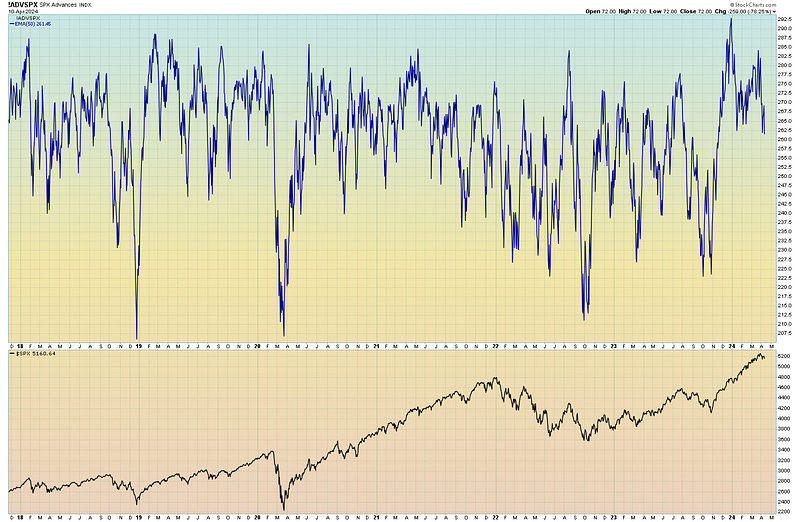

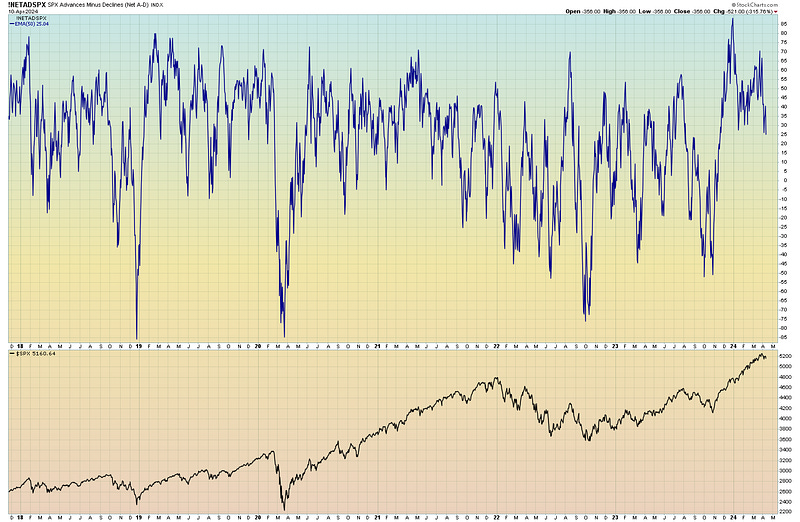

50 Day SPX advancing issues shows the same basic setup as does Net SPX Advances-Declines.

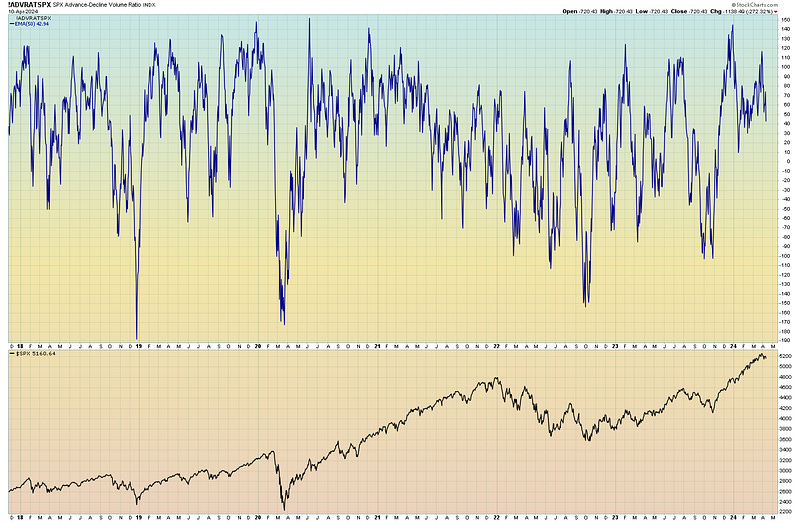

Volume technicals shows the same. 50 day SPX Advance-Decline Volume Ratio.

There are many more similar technical charts. The overall picture on a technical basis is intermediate to longer term bearish, with a solid setup for the C-wave down in a longer term sideways pattern. I expect the entire process to last about 12–18 months before the next long term buy setup emerges.

“The Economy” has cracks that are starting to show and can’t be hidden by happy talk from DC. The Fed is not well positioned to cut rates and will have to at least hold current policy, which is not what traders have been betting on. Expect to see a wave of bankruptcies and mergers in the smaller cap sectors.

The entire domestic and global economy is going to be reset by AI, robotics and related tech. Business and economic models of the past will simply no longer apply. While the new paradigm gets sorted out, there will be a lot of interim chaos. And of course there’s this little thing called World War III which is already well under way (has been for years, as I have been telling you). And of course there’s the civil wars in the western nations which could get kinetic in this election year.

Long term “markets” will move higher as more and more future value is funneled into the present through the debt mechanism. Eventually, the productivity gains by world changing tech will start to realized present value, and economics will change into something entirely new. I have a good idea about what that will be and I will be writing about that.

Be sure to join the new site. Much more to come! And more frequent updates on the “market” and economic situation. Stay tuned!